Jan. 13, 2007: EDC-Competition, Disclosure, Access to Information

To view any screen capture enlarged, double click. Then select back to return to the main page.

Export Development Corporation - High risk - Taxpayer backing - Disclosure or lack thereof - Consultation - Who win?

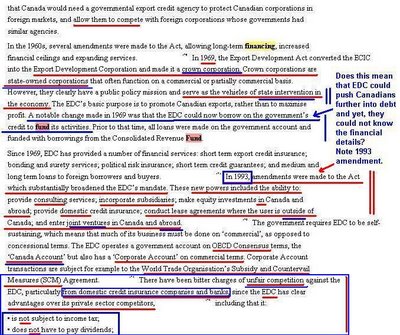

Is EDC unfair competition against domestic credit insurance companies and banks?

Would this constitute unfair competition for some businesses, along with high risk on the backs of Canadian taxpayers?

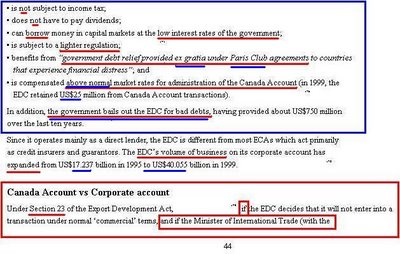

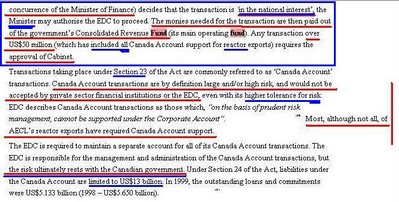

These are high risk loans, hence the use of the Canada Account; yet, in the end, if a country defaults (from what I can see), the taxpayers are left with the bills. If Canada forgives loans, taxpayers are still required to pay what is owed. Who benefit?

Note the "if" these ministers decide something is "in the national interest"

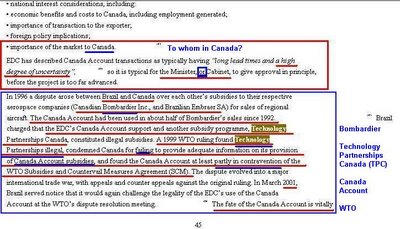

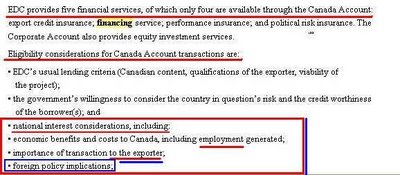

See the block at the bottom of the above screen capture and the beginning part of the one below. A Canada Account may be used when the Minister determines there are "national interest considerations" and these may be "importance of transaction to the exporter" and "foreign policy implications". Is the "exporter" the company or companies involved ... or the country?

Bombardier, TPC, Canada Account

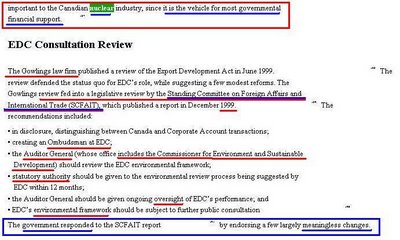

EDC Consultation Review: Result? A few "meaningless changes"

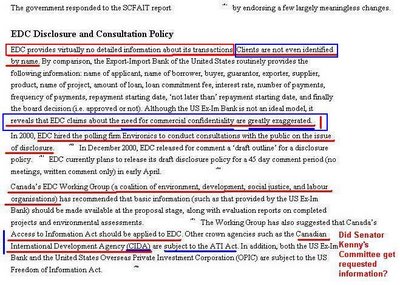

Privacy, Secrecy, Confidentiality, Access to Information

See information from CIDA officials giving Evidence before the Senate committee. It is so worthwhile to read. Unbelievable, at first glance! Maybe there is another explanation, but it seems as if there were an attempt to obfuscate to the Committee.

0 Comments:

Post a Comment

<< Home